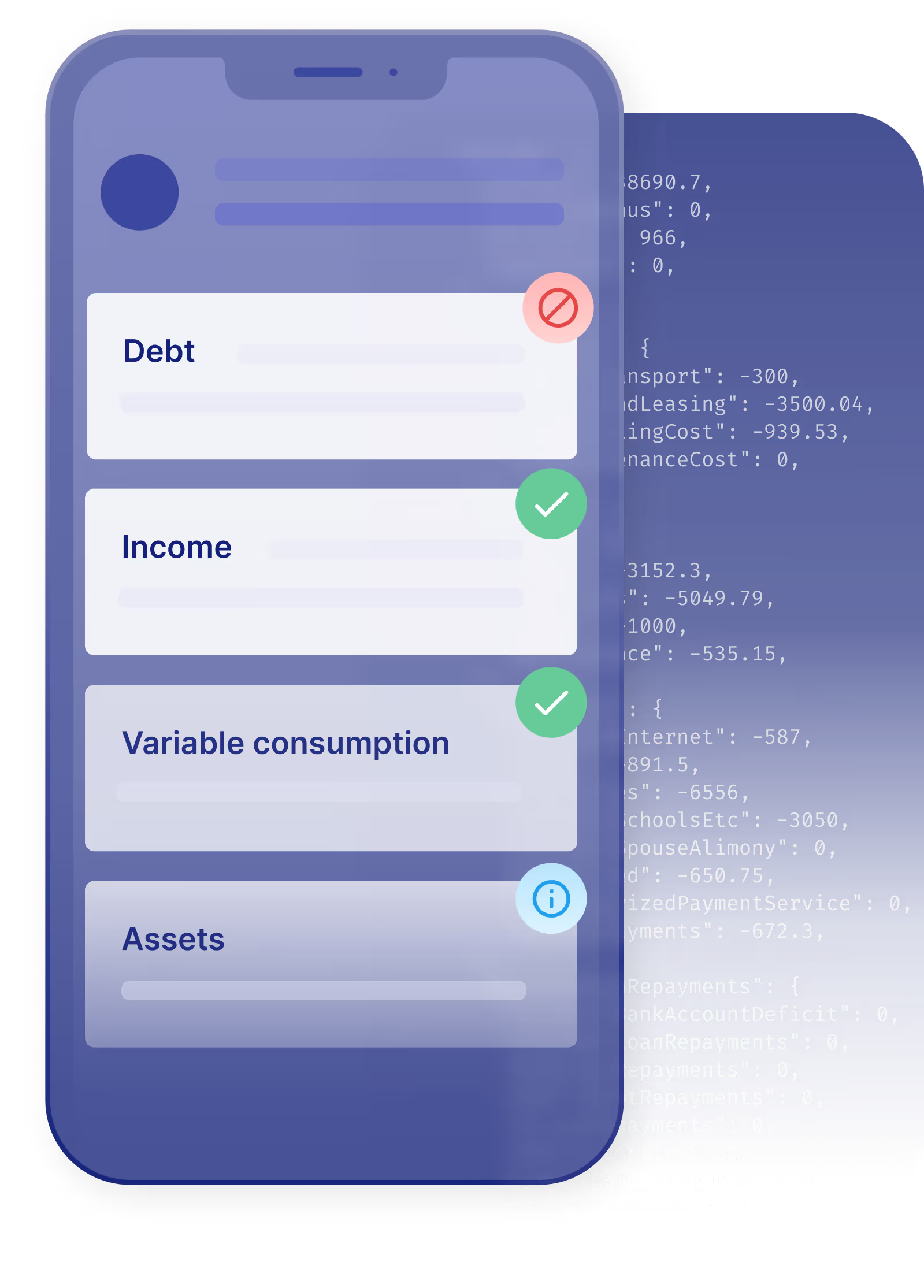

Avoid over-indebtedness

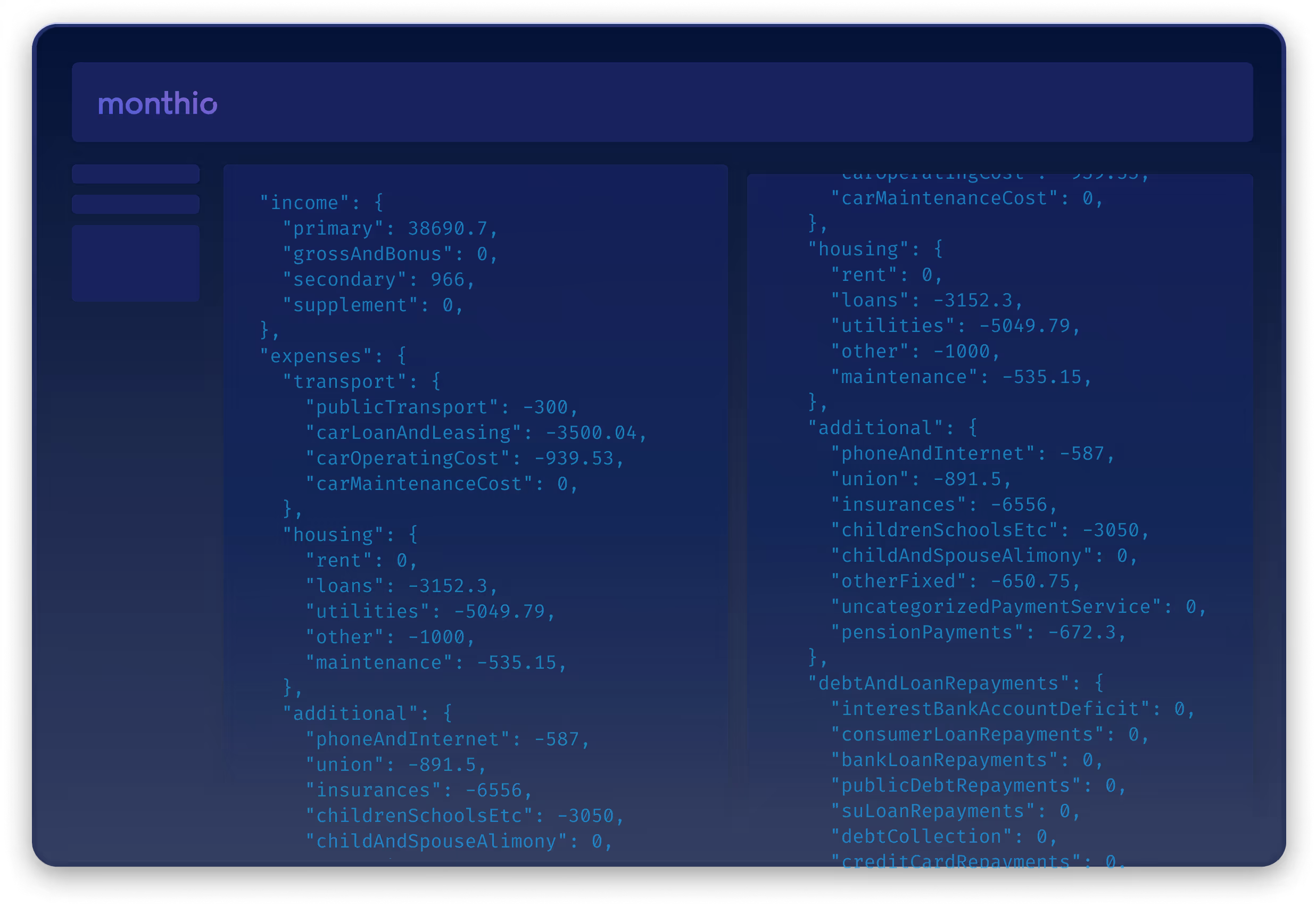

Instead of manually calculating your applicants’ debt factors, relying on out-dated loan data and blanket guidelines, you get precise and reliable information on the current and future financial health of your specific applicant.